|

[Markets]

Stock Market Does Sharp About-Face; Dow Breaks Win Streak

Stock market indexes unexpectedly reversed course in afternoon trading Wednesday, sending the major indexes lower by more than 1%. The Dow Jones Industrial Average couldn't add to its nine-day win streak after reaching all-time highs.

Published:12/20/2023 3:39:29 PM

|

|

[Markets]

Stock Market Reverses Sharply Lower; FedEx Stock Worst In S&P 500

In stock market action the Dow Jones pulled back after flirting with record highs. GOOGL stock broke out and hit a buy point of a base.

Published:12/20/2023 2:23:34 PM

|

|

[Markets]

Stocks Turn Lower in Afternoon Trading

The stock market’s long rally is hitting a wall. The Dow Jones Industrial Average is down 36 points, or 0.1%, while the S&P 500 and Nasdaq Composite are falling 0.2% and 0.1%, respectively. All three indexes were in the green earlier.

Published:12/20/2023 1:56:22 PM

|

|

[Markets]

Dow Jones Touches Record Highs, Helped By These Economic Data Surprises

Dow Jones fell slightly after economic data. Friday's inflation report looms. GOOGL broke out. Apple is in a buy zone.

Published:12/20/2023 11:36:55 AM

|

|

[Markets]

Dow Jones Index Flat On Strong Economic Data; Magnificent Seven Stock Breaks Out To New High

Dow Jones fell slightly after economic data. Friday's inflation report looms. GOOGL broke out. Apple is in a buy zone.

Published:12/20/2023 10:18:40 AM

|

[Markets]

Futures Slide, Brent Jumps Back Over $80 As Red Sea Woes Spread

Futures Slide, Brent Jumps Back Over $80 As Red Sea Woes Spread

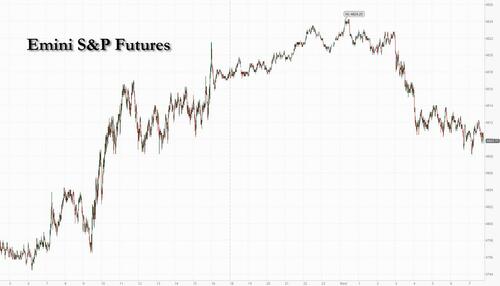

US equity futures and global markets reversed their torrid rally as bonds rallied and the dollar gained after a fresh batch of soft inflation data in the UK boosted the likelihood of interest-rate cuts, but also underscored the risk of an economic downturn. As of 7:45am, S&P eminis dropped 0.2% after the index notched a record high for the third successive session, with European and Asian stocks in the red. Germany 10-year yields dropped below 2% for the first time in nine months after a report showed producer prices fell more than expected in November. Meanwhile, British 10-year borrowing costs slid as much as 11 basis points as slower-than-expected inflation boosted the case for multiple rate cuts next year. Treasury yields slid four basis points to 3.9%, down more than 40 this month. Brent jumped above $80 to a 3 week high after the US considered possible military strikes against Houthi rebels in Yemen, in a recognition that a newly announced maritime task force meant to protect commercial ships in the Red Sea may not be enough to eliminate the threat to the vital waterway. US economic data includes 3Q current account balance (8:30am), November existing home sales and December consumer confidence (10am).

In premarket trading, FedEx shares tumbled as 10% after the parcel company’s fiscal second-quarter profit came in below expectations, with analysts pointing to a particularly disappointing performance from the Express air-freight unit, which was hit by slowing volumes. Brokers added that the company’s outlook lacked visibility, with Citi calling it “vague.” Here are some other notable premarket movers:

- Cinemark dropped 2.3% as Wells Fargo downgrades the movie theater operator to underweight from equal-weight based on an unattractive box office outlook.

- Clear Channel shares rose 4.2% after Wells Fargo Securities raised the recommendation on the advertising company to overweight from equal-weight. The broker says the upgrade comes as the company returns to growth.

- Coupang shares slid 1.2% as UBS downgrades its rating to neutral, awaiting greater clarity on the e-commerce company’s strategy.

Markets have rallied hard in recent weeks after the Fed's dovish pivot which helped put the tech-heavy Nasdaq 100 on course for its best year since 1999, while the S&P 500 is less than 1% off its record closing peak. Bulls got fresh encouragement Tuesday from Richmond Fed President Thomas Barkin, who suggested the US central bank would “respond appropriately” if recent progress on inflation continued. Money markets now price almost a 50% chance of an euro-area rate cut by next March, while seeing an even higher probability of a Fed cut that month. That said, even Powell's unofficial mouthpiece, Nikileaks, aka Nick Timiraos is now warning that the market that it has gone up too far, too fast.

At the same time, investors are also having to balance rate-cut optimism against the risk of economic recession. Recent data has backed that view, especially in the euro area, with analysts surveyed by Bloomberg forecasting the first recession since the pandemic.

“It’s hard to see such a fast and deep rate-cutting cycle as the market appears to assume, unless the base case is a deep recession,” said Daniele Antonucci, chief investment officer at Quintet Private Bank.

Investors are also starting to weigh risks stemming from potential shipping delays and freight cost increases, as companies divert cargoes away from the Red Sea to avoid militant attacks. This rerouting will mean higher shipping costs and longer delivery time, and has helped push brent crude prices above $80 for the first time in 3 weeks.

The big econ news overnight was the latest confirmation that a global deflationary wave is being unleashed, with UK reporting inflation that came in below the lowest estimate. The UK data “adds to the mounting evidence that global inflation has begun to crumble on a broader basis,” said Christoph Rieger, head of rates research at Commerzbank.

While the data initially boosted European stocks, gains on the Stoxx 600 index quickly evaporated, though London’s export-oriented FTSE 100 benchmark held its gains as the pound tumbled on the prospect of looser monetary policy. The telecom sector lead the advance, boosted by Spain’s Telefonica. The health-care sector underperforms, meanwhile, dragged lower by Argenx, which plunges after disappointing drug trial data. Among single stocks, shipping companies Hapag Lloyd AG and AP Moller-Maersk A/S rallied as militant attacks continued to disrupt Red Sea container traffic. Here are the biggest movers Wednesday:

- Telefonica shares jump as much as 7.2% after the Spanish state unveiled a plan to buy up to 10% in the telecom operator to counter stakebuilding by Saudi Telecom Co.

- Intertek gains as much as 3.7% after BNP Paribas Exane double-upgrades to outperform, saying in note that consensus is now overly bearish on margin outlook

- Raiffeisen Bank surges 12%, the most since March 2022, following its deal to buy a stake in Austrian construction company Strabag, with Citi upgrading the stock to buy from neutral

- British stocks rally as data showed inflation in the UK slowed far more than expectations, driving European stocks closer to early 2022 record, with landlords leading the advance

- Indivior gains as much as 4.5% after settling a drug patent dispute with rival Actavis, which now is granted a license to the patent that would enable Actavis to launch a generic variant

- Ionos gains for a ninth day as Morgan Stanley says the webhosting firm has delivered “two early Christmas presents” in strong guidance on Tuesday and last week’s debt refinancing.

- Argenx shares plunge as much as 35% after its key drug Vyvgart (efgartigimod) failed another trial, a second setback in less than a month for the Brussels-listed biotech firm

- DS Smith falls as much as 2.8% after UBS downgraded the paper and packaging company to neutral from buy, saying the downgrade reflects weaker containerboard prices

- Inficon shares fell as much as 5.3%, the most in two months, after the Swiss vacuum instruments manufacturer was downgraded to reduce from add at Baader Helvea

- Resurs Holding drops as much as 8.3% after SEB Equities downgrades the retail finance company to sell from hold, giving the stock its only negative analyst rating

In FX, GBP/USD falls as much as 0.7% to below $1.27 after UK CPI data, EUR/USD down 0.3%; the Bloomberg Dollar Spot Index is largely unchanged as the US currency’s gains versus European currencies are offset by its slide against the yen. The Japanese yen is the best performer among the G-10 currencies, rising 0.3% versus the greenback on false expectations that the BOJ will end its negative rate policy in the coming months which has supported the yen. The dollar has been struggling as investors seek more guidance from the Fed on how soon it will begin cutting rates next year as inflation slows; however Chicago Fed’s Goolsbee said on Tuesday that the market may be getting ahead of itself when it comes to rate cuts.

“Speculative bets on a BOJ policy change are likely to ease for now,” said Fukuhiro Ezawa, head of financial markets in Tokyo at Standard Chartered Bank. “Markets price in deep Fed rate cuts, weighing on the dollar” against peers including the yen, he said

In rates, the yield on the 10-year US Treasury slips 4bps to 3.88%, its lowest since late July. Traders are betting that the Fed will cut rates by 150bps by the end of 2024, compared with around 140 bps on Tuesday. UK gilts rallied while the pound drops after data showed UK inflation slowed more than expected in November, fueling bets on interest rate cuts by the Bank of England next year. UK two-year yields fall 15 basis points to 4.14%, a seven-month low.

In commodities, oil extended its recent rally amid prospects of more disruptions in the Red Sea, while the US weighs military strikes on Houthis. Brent jumped above $80 to a three week high. Brent March call options in the $90s were active again on Tuesday as traders continue to weigh the risks to traffic in the Red Sea. WTI’s second-month 25-delta put skew was the least bearish since mid-November. Brent’s prompt spread climbed to the strongest since Dec. 5, while its Dec.-Dec. spread was the firmest this month.

Bitcoin (+0.6%) and Ethereum (+1.2%) extended gains as BTC rose back over USD 43k. BlackRock, Nasdaq, SEC met regarding a Bitcoin (BTC) ETF, via CoinDesk

Looking to the day ahead now, and data releases from the US include the Conference Board’s consumer confidence for December, existing home sales for November, and the Q3 current account balance. In the Euro Area, there’s the European Commission’s preliminary consumer confidence indicator for December, and there’s also the UK CPI and German PPI readings for November. From central banks, we’ll hear from the Fed’s Goolsbee and the ECB’s Lane.

Market Snapshot

- S&P 500 futures down 0.2% to 4,812.50

- STOXX Europe 600 little changed at 476.63

- MXAP up 0.5% to 165.32

- MXAPJ up 0.2% to 515.45

- Nikkei up 1.4% to 33,675.94

- Topix up 0.7% to 2,349.38

- Hang Seng Index up 0.7% to 16,613.81

- Shanghai Composite down 1.0% to 2,902.11

- Sensex down 1.1% to 70,636.67

- Australia S&P/ASX 200 up 0.7% to 7,537.88

- Kospi up 1.8% to 2,614.30

- German 10Y yield little changed at 1.99%

- Euro down 0.2% to $1.0961

- Brent Futures up 0.8% to $79.87/bbl

- Gold spot up 0.1% to $2,041.67

- U.S. Dollar Index little changed at 102.26

Top Overnight News

- Bond yields across the euro region fell on Wednesday as worsening economic data and slowing inflation underscored expectations for interest-rate cuts next year.

- UK inflation slowed far more than economists forecast in November, a surprise that prompted traders to boost bets the Bank of England will soon have to abandon its higher-for-longer narrative on interest rates.

- Attacks in the Red Sea linked to the Israel-Hamas war will cause shipping delays and drive up the price of goods, bringing a new inflation risk to the economy.

- Jonathan Hoffman, John Bonello and Jonathan Tipermas share more than just similar first names. They’re the driving force behind a gigantic wager on government debt that’s been giving regulators sleepless nights.

- Donald Trump is ineligible to serve as US president because of his actions inciting the Jan. 6, 2021 attack on the US Capitol, Colorado’s highest court found, in an unprecedented ruling that’s headed for the US Supreme Court.

- Throngs of consultants wearing Western attire have become a common sight in the lobbies of Riyadh’s plushest hotels as Crown Prince Mohammed Bin Salman embarks on a multi-trillion dollar plan to wean Saudi Arabia off oil. In recent months they’ve been joined by another cohort of besuited individuals: fund managers, keen to get an early foothold in the next big emerging-market growth story.

A more detailed look at global markets courtesy of NEwsquawk

Asia-Pac stocks traded mostly positively following the tailwinds from Wall Street, although newsflow overnight was on the quieter side amid the pre-Christmas lull. ASX 200 saw its upside supported by the Energy and Metals sectors, whilst Tech lagged with shallower gains. Nikkei 225 surged as the index reacted to BoJ Governor Ueda's dovish press conference following the unchanged announcement yesterday. Hang Seng and Shanghai Comp traded mixed with the former's gains spearheaded by large caps with US listings, including Alibaba, JD.com, and Baidu. Mainland China was subdued after PBoC maintained its Loan Prime Rates as expected and despite more liquidity injections by the central bank.

Top Asian News

- PBoC maintained its 1-year and 5-year LPRs at 3.45% and 4.20% respectively, as expected.

- PBoC injected CNY 134bln through 7-day reverse repos at 1.80% and CNY 151bln via 14-day reverse repos at 1.95%; both rates maintained

- The Japanese government is to raise its long-term interest rate estimate to 1.9% for FY24 from 1.1% in FY23, according to Nikkei.

- Japanese Cabinet projects that income will increase more than prices in FY24, according to Nikkei.

- State-backed developer China South City averts default on July 2024 note after consent from bondholders, according to SCMP.

- RBNZ Governor Orr said interest rates are restricting spending and levels of core inflation remain too high, according to the Parliamentary hearing. He noted that Q3 GDP was surprisingly subdued, and inflation remains too high and the committee remains wary of ongoing inflationary surprises. He said the neutral interest rate is now 2.5%.

- New Zealand DMO and fiscal update: gross bond issuance for four years to June 2027 now totals NZD 136bln, up from NZD 129bln in the budget. 2023/24 gross bond issuance increases to NZD 38bln from NZD 36bln in budget. Treasury sees GDP growth in Q4 23 and through 2024.

- Japan is to draft an initial FY24 budget of JPY 112tln, via Kyodo News

- Japanese government is to lower the scheduled sales of JGBs to market by 11.2% from FY23 plan to JPY 171tln in FY24/25, via Reuters citing a draft

European bourses, Eurostoxx50 (-0.2%), are marginally weaker having spent much of the morning the green; the FTSE 100 (+0.8%) outperforms post-UK CPI. European sectors are mixed with Energy outperforming lifted by gains in underlying Crude prices and Telefonica (+5%) helps lift Telecoms; Technology narrowly lags. US Equity Futures are lower across the board as the Santa Rally comes to a pause, ES (-0.2%); FedEx (-9.9%) extends losses in the pre-market post-earnings.

Top European News

- ECB's Nagel says there is a high probability that the interest rate peak has been reached, according to t-online; would say to everyone who is speculating on an imminent interest rate cut: be careful, some people have already speculated.

- France and Germany see an EU deal on fiscal rules on Wednesday, according to Bloomberg.

- Bank of France Survey: Expectations for inflation one year out ease to 3.5% in Q4 (prev. 4%); 3.5% increase in wages (prev. 3%)

FX

- DXY propped up by the softer Pound and Euro, though with gains capped by upside in the Yen; within a 102.14-34 range.

- The Pound is the G10 laggard post-CPI, falling to a session low of 1.2648.

- EUR is weighed on by the firmer Dollar, with softer German PPI unhelpful for the Single-Currency while EUR/GBP action offers only marginal respite.

- The Yen is the best performer amongst the G10s, paring back some of yesterday's BoJ's induced losses, but yet to test 143.00.

- PBoC sets USD/CNY mid-point at 7.0966 vs exp. 7.1300 (prev. 7.0982)

Fixed Income

- USTs are modestly higher in tandem with Gilts as markets await the US 20yr auction and further speak from Fed's Goolsbee.

- Gilts outperforms after cooler-than-expected UK CPI, adding to dovish expectations for 2024; gapped higher by almost 100 ticks and thereafter eclipsed 103.00.

- Bunds are bid in conjunction with Gilts and after its own softer Producer Prices metrics; German 10yr yield sub-2.0% for the first time since March.

Commodities

- WTI and Brent (+1.2%) are bid having spent the overnight session relatively indecisive; specifics have been light and largely led by geopolitical themes.

- Spot Gold (-0.1%) resides on either side of the unchanged mark, holding on to the prior day's gains; Base metals are generally in the green, though with gains capped amid poorer sentiment in China overnight.

- Intensive talks are underway on a potential second Gaza truce, via Reuters citing sources; envoys looking at which hostages could go free.

Geopolitics

- US reportedly weighs whether to attack Houthis beyond defensive task force and possible strikes on Houthis in Yemen considered, according to Bloomberg sources; no decision made yet on striking Houthis. The US and its allies are considering possible military strikes against Houthi rebels in Yemen, in recognition that a newly announced maritime task force meant to protect commercial ships in the Red Sea may not be enough to eliminate the threat to the vital waterway. Planning is underway for actions intended to cripple the Houthis’ ability to target commercial ships by hitting the militant group at the source.

- Israel is offering to pause the fighting in Gaza for at least one week as part of a new deal to get Hamas to release more than three dozen hostages, according to Axios sources.

- Malaysia bans Israeli-based shipping firm Zim from its ports, with the ban set to take effect immediately, according to the Malaysian PM.

US Event Calendar

- 07:00: Dec. MBA Mortgage Applications -1.5%, prior 7.4%

- 08:30: 3Q Current Account Balance, est. -$196b, prior -$212.1b

- 10:00: Nov. Home Resales with Condos, est. 3.78m, prior 3.79m

- Nov. Existing Home Sales MoM, est. -0.4%, prior -4.1%

- 10:00: Dec. Conf. Board Consumer Confidence, est. 104.5, prior 102.0

- Dec. Conf. Board Present Situation, prior 138.2

- Dec. Conf. Board Expectations, prior 77.8

DB's Henry Allen concludes the overnight wrap

The relentless market rally has continued over the last 24 hours, with investors remaining confident that central banks will soon pivot towards rate cuts, despite the pushback from several officials over recent days. In fact, yesterday saw the S&P 500 (+0.59%) hit another 23-month high, which leaves the index less than 1% beneath its all-time closing peak back in January 2022. That also means t he index has now risen by +15.8% in less than two months, and we haven’t seen an advance that fast since March-May 2020, back when the S&P 500 was recovering from the initial Covid selloff. At the same time, sovereign bonds have continued to rally, and overnight the 10yr Treasury yield has fallen to its lowest level since July, at 3.91% .

This growing anticipation of rate cuts was supported by Richmond Fed President Barkin, who said that “If you’re going to assume that inflation comes down nicely, of course we would respond appropriately”. That helped push Treasury yields lower, and offered support for the idea that the Fed would cut rates if inflation fell, since otherwise it would mean that policy was becoming more restrictive in real terms. But we also had a more hawkish take from Atlanta Fed President Bostic, who said that “there’s not going to be urgency for us to pull off our restrictive stance”, expecting only two rate cuts in 2024, rather than the three rate cuts that the median dot suggested. Both are voting members of the FOMC in 2024.

Against that backdrop, investors continued to price in a strong chance of a Fed rate cut by March, with the probability moving up from 75% to 83% yesterday. And it was the same story for the ECB, where the chance of a March cut rose from 35% to 49%, even as Latvia’s central bank governor said that “it is too early to declare victory over inflation” .

Those moves led to a s izeable rally in sovereign bonds in the European session. Yields on 10yr OATs (-8.5bps) fell to their lowest level since February, those on 10yr gilts (-4.3bps) fell to their lowest since April, and those on 10yr BTPs (-13.4bps) were at their lowest since December 2022. 10yr bund yields (-6.3bps) also fell back, although they were just above their closing level from Friday, at 2.01%. Over in the US, 10yr Treasury yields had traded nearly -4bps lower early on in the US session but were flat by the close (-0.1bps) at 3.93%, but overnight they’ve since fallen -2.4bps to 3.91%.

That growing conviction about rate cuts came despite some hawkish-leaning data that was released yesterday. For instance, Canada’s CPI print for November was stronger than expected, with headline CPI remaining at +3.1% (vs. +2.9% expected). Moreover, US housing starts also surprised on the upside, hitting a 6-month high in November as they rose to an annualised rate of 1.56m (vs. 1.36m expected). The release meant that the Atlanta Fed’s GDPNow estimate rose another tenth yesterday, and it now sees US Q4 GDP expanding at an annualised +2.7% pace .

The prospect of faster growth alongside rate cuts proved supportive for equities, and the S&P 500 (+0.59%) advanced for the 8th time in the last 9 sessions. It was a broad-based advance, with 23 of the 24 S&P 500 industry group up on the day and both the FANG+ index (+0.51%) and the Dow Jones (+0.68%) reaching all-time highs. Small-cap stocks did particularly well on the day, and the Russell 2000 (+1.94%) surpassed its recent peak in July to close at its highest level since August 2022. Meanwhile in Europe, the STOXX 600 (+0.36%) closed at a 22-month high, with its YTD gain now standing at +12.27%.

That optimism has been echoed in Asia overnight, where most indices have seen a decent rally. That includes the KOSPI (+1.65%), the Nikkei (+1.51%) and the Hang Seng (+1.08%), although the CSI 300 (-0.50%) and the Shanghai Comp (-0.42%) have seen an underperformance. That follows the move by Chinese banks to leave the 1yr and 5yr loan prime rate unchanged. Otherwise, US equity futures are broadly flat this morning, with those on the S&P 500 up +0.03%.

Meanwhile in Japan, sovereign bond yields have continued to fall after the BoJ’s decision to leave its policy unchanged yesterday, with the 10yr JGB yield down a further -6.4bps overnight to its lowest since July, at 0.55%. As we were going to press yesterday, Governor Ueda said in the press conference that there “isn’t much likelihood of us suddenly announcing that we’ll raise rates a month in advance”, so that’s a different approach to other central banks like the Fed, who tend to signal their moves in advance. Looking forward, investors still see a serious probability that the BoJ will move away from their negative interest rate policy over the months ahead, and currently they price in a 39% chance of a shift in January, and a 75% chance of a move by April. This morning, the Japanese yen has stabilised against the dollar, strengthening +0.10% to trade at 143.69 per dollar as we go to press. However, Japanese banks have continued to lose ground amidst the continuation of low borrowing costs, and the TOPIX Banks Index (-0.19%) is on track to lose ground for a 5th consecutive session, and is currently at its lowest level since July .

In the commodity space, oil prices advanced yesterday, with Brent crude up +1.64% to $79.23/bbl and WTI up +1.34% to $73.44/bbl. The two oil benchmarks have risen by +8.2% and +7.0% respectively over the past week, with the main driver being the pause of much commercial shipping via the Red Sea in response to recent attacks and rising perceptions of geopolitical risks.

To the day ahead now, and data releases from the US include the Conference Board’s consumer confidence for December, existing home sales for November, and the Q3 current account balance. In the Euro Area, there’s the European Commission’s preliminary consumer confidence indicator for December, and there’s also the UK CPI and German PPI readings for November. From central banks, we’ll hear from the Fed’s Goolsbee and the ECB’s Lane.

|

|

[Markets]

Dow Jones, Nasdaq Threaten To Snap Win Streak; FedEx Dives On Earnings

Dow Jones futures dropped Wednesday ahead of key economic data. Shipping giant FedEx dived on weak earnings results.

Published:12/20/2023 7:26:36 AM

|

|

[Markets]

Stock Futures Slip After Dow Hits New Highs

U.S. stock markets were set for a slightly weaker open Wednesday as investors gauged whether the recent stock rally inspired by the Federal Reserve can continue. Dow Jones Industrial Average futures were down less than 0.1%. S&P 500 futures slipped and Nasdaq Composite futures were down 0.2%.

Published:12/20/2023 3:25:13 AM

|

|

[Markets]

Stock Futures Waver as Dow Hits New Highs

U.S. stock markets were set for a muted open Wednesday as investors gauged whether the recent stock rally inspired by the Federal Reserve can continue. Dow Jones Industrial Average futures were up 1 point, or less than 0.1%. The Dow reached its fifth consecutive record close on Tuesday, with hopes for interest-rate cuts still powering market gains.

Published:12/20/2023 3:11:28 AM

|

|

[Markets]

Dow Jones Industrial Average On Track For 9th Straight Gain; Is It Time To Buy These 'Dogs Of The Dow'?

The Dow Jones Industrial Average lifted into new-high territory again as the bulls continued their reign in the stock market today. Walgreens, up 2.7% for the week, still trades 35% below a 52-week high and 73% off an all-time peak of 97.30. Is it time, as some market pundits suggest, to buy the dogs of the Dow?

Published:12/19/2023 2:41:24 PM

|

|

[Markets]

Dow Jones Leader Microsoft, Netflix In Buy Zones In Today's Stock Market

Dow Jones tech titan Microsoft and streaming giant Netflix join these two leaders in or near buy zones in today's stock market rally.

Published:12/19/2023 1:56:24 PM

|

|

[Markets]

Stock Market Rally Continues As Dow Jones Sets Another Record; S&P Hits New Mark

Major indexes added to their December rally in morning action on the stock market Tuesday, as the Dow Jones Industrial Average climbed more than 100 points and reached another all-time high. The Dow Jones Industrial Average gained 0.5% in recent trades, while the Nasdaq composite also climbed 0.5 %. The S&P 500 added 0.4% in the stock market today and hit a new 52-week high.

Published:12/19/2023 10:02:03 AM

|

|

[Markets]

Dow Jones Extends Winning Streak; Netflix Among 7 Best Stocks To Buy And Watch

The Dow Jones rose Tuesday after key economic data. Netflix stock is among the best stocks to buy and watch in today's market.

Published:12/19/2023 8:40:30 AM

|

|

[Markets]

Dow Jones Futures Extend Their Winning Streak; Netflix Among 7 Best Stocks To Buy And Watch

Dow Jones futures rose Tuesday ahead of key economic data. Netflix stock is among the best stocks to buy and watch in today's market.

Published:12/19/2023 7:35:40 AM

|

|

[Markets]

Dow Jones Futures: Nasdaq, S&P 500 Hit New Highs; These Magnificent Seven Stocks Race Higher

Dow Jones futures: The Nasdaq and S&P 500 hit new highs Monday, as Magnificent Seven stocks Alphabet, Amazon, Meta and Nvidia raced higher.

Published:12/19/2023 7:01:51 AM

|

|

[Markets]

The Zacks Analyst Blog Highlights SPDR Dow Jones Industrial Average ETF, First Trust Dow 30 Equal Weight ETF, Invesco Dow Jones Industrial Average Dividend ETF, ProShares Ultra Dow30 ETF and ProShares UltraPro Dow30

SPDR Dow Jones Industrial Average ETF, First Trust Dow 30 Equal Weight ETF, Invesco Dow Jones Industrial Average Dividend ETF, ProShares Ultra Dow30 ETF and ProShares UltraPro Dow30 are included in this Analyst Blog.

Published:12/19/2023 4:41:22 AM

|

|

[Markets]

Dow Jones Up As Netflix Clears Entry; Cathie Wood Buys This Soaring Stock, Sells Bitcoin Plays

The Dow Jones rose. Cathie Wood snapped up a stock on a strong run but sold Bitcoin stocks. Netflix stock cleared a buy point but Apple fell.

Published:12/18/2023 4:57:42 PM

|

|

[Markets]

Dow Jones Up As Adobe Pops; Cathie Wood Snaps Up This Stock On 65% Run, Sells Bitcoin Plays

The Dow Jones gained as other indexes rose. Cathie Wood snapped up a stock amid a powerful run. And Adobe rose as a deal crumbled.

Published:12/18/2023 3:04:09 PM

|

|

[Markets]

Dow Jones At Record Highs; Tesla Rival Wins $2 Bil Deal As Apple Responds To Ban

Dow Jones continued to rise to record highs after economic data Monday. Tesla rival Nio surged on a new investment. Nike, Micron earnings loom.

Published:12/18/2023 12:11:32 PM

|

|

[Markets]

Tech Stocks Lead Gains Monday

The stock market is gaining Monday, with technology shares leading the way higher. The Dow Jones Industrial Average has risen 39 points, or 0.1%, while the S&P 500 has gained 0.5% and the tech-heavy Nasdaq Composite is up 0.

Published:12/18/2023 11:56:28 AM

|

|

[Markets]

Dow Jones Holds Record Highs After Economic Data; Tesla Rival Wins $2 Bil Deal

Dow Jones continued to rise to record highs after economic data Monday. Tesla rival Nio surged on a new investment. Nike, Micron earnings loom.

Published:12/18/2023 10:11:28 AM

|

|

[Markets]

Dow Jones Rises After Key Housing Data; Netflix Stock Is Breaking Out Today

The Dow Jones Industrial Average rose Monday after key housing data. Netflix stock is breaking out today past a new buy point.

Published:12/18/2023 9:17:29 AM

|

|

[Markets]

Stocks Are Rising After Another Strong Week

The stock market is pushing higher after it closed out a strong week Friday. The Dow Jones Industrial Average is up 45 points, or 0.1%, while the S&P 500 has gained 0.3% and the Nasdaq Composite has advanced 0.2%. The market is confident that the economy can continue to grow as the Federal Reserve potentially moves towards cutting interest rates from hiking them.

Published:12/18/2023 8:49:10 AM

|

|

[Markets]

Dow Jones Futures Rise Ahead Of Key Housing Data; Tesla Stock Hits Buy Point

Dow Jones futures rose Monday ahead of key housing data. Tesla stock hit a new buy point last week and is in buy range.

Published:12/18/2023 8:22:19 AM

|

|

[Markets]

Dow Jones Marks 7th Straight Weekly Gain As Boeing Stock Jumps; DocuSign Surges On Takeover Chatter

The Dow Jones, S&P 500 and Nasdaq composite extended their weekly win streaks to seven on a quadruple-witching Friday.

Published:12/15/2023 3:42:42 PM

|

|

[Markets]

Dow Jones Holds Near Highs As Boeing Stock Jumps; DocuSign Surges On Takeover Chatter

The Dow Jones, S&P 500 and Nasdaq composite were on pace for their seventh straight weekly gain on quadruple-witching Friday.

Published:12/15/2023 2:23:49 PM

|

|

[Markets]

Dow Flat While Nasdaq Keeps Climbing; Costco Hits All-Time High

The stock market showed mixed results early Friday as the Dow Jones Industrial Average eased off record highs.

Published:12/15/2023 10:36:27 AM

|

|

[Markets]

Why Are Tech Stocks Up—and the Dow Down—Today?

Technology stocks are in the green Friday, bucking the broader trend. The tech-heavy Nasdaq Composite is up 0.3%, while the Dow Jones Industrial Average has dropped 40 points, or 0.1% and the S&P 500 is flat 0.1%. Tech stocks had underperformed Thursday, but analysts expect many of the mega-sized tech companies to grow earnings faster than the S&P 500 over the next couple of years.

Published:12/15/2023 10:00:13 AM

|

|

[Markets]

Dow Jones Futures Fall Amid Key Economic Data; Costco Rallies On Earnings

Dow Jones futures dropped Friday amid key economic data, as the stock market hit more new highs. Costco stock rallied on earnings.

Published:12/15/2023 8:07:48 AM

|

|

[Markets]

Dow Jones Futures Keep Rising Ahead Of Economic Data; Costco Rallies On Earnings

Dow Jones futures rose Friday ahead of key economic data, as the stock market hit more new highs. Costco stock rallied on earnings.

Published:12/15/2023 7:23:28 AM

|

|

[Markets]

Futures gain as rate-cut cheer persists

The Fed left interest rates unchanged on Wednesday, acknowledging slowing inflation and indicated lower borrowing costs were on the horizon, causing the Dow Jones Industrial Average to notch its second straight record high close on Thursday. Money markets see a 79% chance of at least a 25-basis point rate cut as soon as March 2024, up from about 50% before Wednesday's policy announcement, while almost fully pricing in another cut in May 2024, according to CME Group's FedWatch tool.

Published:12/15/2023 5:13:42 AM

|

|

[Markets]

Stock market today: Asian markets churn upward after the Dow ticks to another record high

Asian shares powered higher on Friday after the Dow Jones Industrial Average climbed to another record on excitement that the Federal Reserve might cut interest rates several times next year. Troubled developer Country Garden's shares jumped 5.1%, while China Evergrande gained 2.2% and Sino Ocean Holding surged 6.8%. China's National Bureau of Statistics reported that factory output rose 6.6% in November and retail sales were up more than 10%, glimmers of improvement for the economy after the post-COVID recovery faded much more quickly than expected.

Published:12/15/2023 1:51:05 AM

|

|

[Markets]

Stocks Close Higher. The Dow Hits Second Consecutive Record High

The stock market ended the day in the green, with the Dow Jones Industrial Average closing at its second consecutive all-time high. The Dow gained 158 points, or 0.4%, while the S&P 500 rose 0.3% and the Nasdaq Composite advanced 0.

Published:12/14/2023 3:18:23 PM

|

|

[Markets]

Dow Jones Pares Gains Amid 'Goldilocks' Set Up; Moderna Soars On Cancer Vaccine

Dow Jones rose to new highs after retail sales beat views while initial unemployment claims came in lower than expected. Moderna soared.

Published:12/14/2023 2:41:48 PM

|

|

[Markets]

S&P 500 clings to gain, Nasdaq turns negative and Dow hits pause on record-setting rally

U.S. stocks are pulling back from session highs after Dow Jones carves out a fresh record.

Published:12/14/2023 12:57:00 PM

|

|

[Markets]

Tech Stocks Dip, Giving Up Earlier Gains

Technology stocks are giving up earlier gains and falling into the red Thursday. The tech-heavy Nasdaq Composite is down 0.2% after having spent much of the day in the green. Meanwhile, the Dow Jones Industrial Average is up 81 points, or 0.2%, while the S&P 500 has advanced 0.1%.

Published:12/14/2023 12:47:47 PM

|

|

[Markets]

Dow Jones Rallies After Surprise Jobless Claims, Retail Sales; Adobe Dives On Earnings

The Dow Jones rallied Thursday after a surprise drop in initial unemployment claims and U.S. retail sales. Adobe stock dived on earnings.

Published:12/14/2023 9:25:03 AM

|

|

[Markets]

Dow Jones Futures Keep Surging Ahead Of Jobless Claims, Retail Sales; Adobe Tumbles On Earnings

Dow Jones futures rose Thursday ahead of the initial unemployment claims and U.S. retail sales. Adobe stock tumbled on earnings.

Published:12/14/2023 7:17:27 AM

|

|

[Markets]

Dow Jones Futures Rise As Market Rally Runs On Fed Rate-Cut Shift; What To Do Now

Futures rose Thursday as Treasury yields tumbled, after the Dow Jones hit a record high on Fed rate-cut forecasts. Here's what to do now. Adobe fell late on guidance.

Published:12/14/2023 6:11:48 AM

|

|

[Markets]

Stock market today: Asian shares are mostly higher after the Dow hits a record high, US dollar falls

Shares were mostly higher in Asia on Thursday after a powerful rally across Wall Street sent the Dow Jones Industrial Average to a record high as the Federal Reserve indicated that interest rate cuts are likely next year. The European Central Bank and Bank of England were expected to keep their interest rate policies unchanged, as were the central banks of Norway and Switzerland. In Asian trading, Tokyo’s Nikkei 225 fell as the yen gained sharply against the U.S. dollar, since a weaker dollar can hit the profits of Japanese exporters when they are brought back to Japan.

Published:12/14/2023 2:39:21 AM

|

|

[Markets]

RPT-US STOCKS-Dow ends at record high as Fed signals lower borrowing costs in 2024

The Dow Jones industrial average hit its first record closing high since January 2022 and the S&P 500 and Nasdaq rallied more than 1% each on Wednesday after the Federal Reserve signaled that its interest rate-hiking policy is at an end and that it sees lower borrowing costs in 2024. In its policy statement, the Fed also left interest rates steady, as expected, and a near-unanimous 17 of 19 Fed officials projected that the policy rate will be lower by the end of 2024.

Published:12/13/2023 4:24:36 PM

|

|

[Markets]

: Dow scores its highest close in history. Here’s what that means.

The Dow Jones Industrial Average swept to a record close on Wednesday, after the Federal Reserve signaled a pivot to rate cuts could be in store for 2024.

Published:12/13/2023 4:05:34 PM

|

|

[Markets]

Dow Jones hits an all-time high as investors cheer progress on inflation

The Dow Jones Industrial Average hits an all-time high as investors cheer progress on inflation.

Published:12/13/2023 3:09:23 PM

|

|

[Markets]

Dow Soars XXX Points to Record Closing High

The Dow Jones Industrial Average sprinted to a new record closing high after the Federal Reserve announced its latest monetary policy decision. The Dow gained 513 points, or 1.4% to close at 37090. The S&P 500 rose 1.

Published:12/13/2023 3:09:23 PM

|

|

[Markets]

Dow Jones eclipses 37,000 intraday for first time ever, heads for record close

Dow Jones eclipses 37,000 intraday for first time ever, heads for record close

Published:12/13/2023 2:52:49 PM

|

|

[Markets]

UPDATE 1-Dow industrials hit intraday record high on rate optimism

The Dow Jones Industrial Average hit its first record high since January 2022 on Wednesday after the Federal Reserve signaled lower borrowing costs are coming in 2024. The Dow was up 1.12% at 36,986.89 points. Ending Wednesday's session at its current level would also mark the Dow's first-record high close since January 2022, and would confirm that it has been in a bull market since tumbling more than 20% through its closing low in September 2022, according to a common definition.

Published:12/13/2023 2:39:57 PM

|

|

[Markets]

Dow Reaches 37000, an Intraday Record High

The Dow Jones Industrial Average hit an intraday record high. The index is up 472 points, or 1.3% to 37049 at last check, reaching over 37000 for the first time. It’s up just a little less than the S&P 500 and Nasdaq Composite, which have gained about 1.

Published:12/13/2023 2:17:54 PM

|

|

[Markets]

Stocks Rise After Fed Holds Rates Steady

The stock market is maintaining its gain after the Federal Reserve announced that it is holding rates steady. The Dow Jones Industrial Average has gained 97 points, or 0.3%, while the S&P 500 is up 0.3% and the Nasdaq has risen 03%. The Fed announced that it will keep the federal funds rate unchanged at a range between 5.25% and 5.50%.

Published:12/13/2023 1:11:12 PM

|

|

[Markets]

Dow Jones Flat Ahead Of Fed; Magnificent Seven Mixed As Tesla Falls On Autopilot Flaw

Dow Jones was flat ahead of the Fed rate decision on Wednesday. Tesla fell while other Magnificent Seven stocks rose.

Published:12/13/2023 11:24:18 AM

|

|

[Markets]

This Market Is Skating on Very Thin Ice

As discussed below, psychology data that have been historically prescient regarding indications of excessive bullish sentiment near market peaks have typically been followed by corrections of varying degrees. On the charts, the major equity indexes closed mixed Tuesday with the S&P 500, DJIA, Nasdaq Composite, Nasdaq 100 and Dow Jones Transports rising as the rest posted losses. Also, the gains on the S&P, DJIA, Nasdaq Composite and Nasdaq 100 pushed their prices above their near-term resistance levels, leaving all in near-term bullish trends and lacking sell signals except for the Dow Transports staying neutral.

Published:12/13/2023 9:53:08 AM

|

|

[Markets]

Dow Jones Falls After Cool Inflation Data; Fed Decision, Powell Up Next

The Dow Jones fell after more key inflation data Wednesday. The Fed's interest rate decision and Powell's comments are later in the day.

Published:12/13/2023 8:44:16 AM

|

|

[Markets]

Stock Futures Hold Gains After PPI Inflation Data

The stock market is gaining after the increase in producer prices came in below expectations. Dow Jones Industrial Average futures were up 39 points, or 0.1%, while S&P 500 futures were rising 0.1% and futures tracking the Nasdaq Composite gained 0.2%. The producer price index for November rose at a 0.9% annual rate, versus estimates of 1% and lower than October’s 1.2% gain.

Published:12/13/2023 7:51:38 AM

|

|

[Markets]

Dow Jones Futures Rise After Cool Inflation Data; Fed Decision, Powell Up Next

Dow Jones futures rose after more key inflation data. The Fed's interest rate decision and Powell's comments are later in the day.

Published:12/13/2023 7:43:56 AM

|

|

[Markets]

Dow Jones Futures Rise Ahead Of Key Inflation Data; Fed Decision, Powell Up Next

Dow Jones futures rose ahead of more key inflation data. The Fed's interest rate decision and Powell's comments are later in the day.

Published:12/13/2023 7:37:14 AM

|

|

[Markets]

Dow Jones Futures Rise; Nasdaq Hits 2023 Highs, Nvidia Reclaims Buy Point With Fed On Tap

Dow Jones futures were little changed after hours, along with S&P 500 futures and Nasdaq futures. The Federal Reserve meeting decision looms large. The stock market rallied Tuesday, with the Nasdaq hitting a 2023 high, joining the S&P 500 and the Dow Jones.

Published:12/12/2023 5:15:33 PM

|

|

[Markets]

Dow Jones Futures Rise: Nasdaq Hits 2023 Highs, Nvidia Reclaims Buy Point With Fed On Tap

Dow Jones futures rose slightly after hours, along with S&P 500 futures and Nasdaq futures. The Federal Reserve meeting decision looms large. The stock market rallied Tuesday, with the Nasdaq hitting a 2023 high, joining the S&P 500 and the Dow Jones.

Published:12/12/2023 4:00:50 PM

|

|

[Markets]

Dow Jones Futures: Nasdaq Hits 2023 Highs, Nvidia Reclaims Buy Point With Fed On Tap

Dow Jones futures tilted higher after hours, along with S&P 500 futures and Nasdaq futures. The Federal Reserve meeting decision looms large. The stock market rallied Tuesday, with the Nasdaq hitting a 2023 high, joining the S&P 500 and the Dow Jones.

Published:12/12/2023 3:54:48 PM

|

|

[Markets]

Dow Jones Falls On CPI Inflation Report; Tech Giant Oracle Dives On Earnings

The Dow Jones dropped Tuesday on the Consumer Price Index inflation report. Tech giant Oracle dived on weak sales results.

Published:12/12/2023 9:01:31 AM

|

|

[Markets]

Dow Opens Flat After November Inflation Report

Inflation came in lower than last month’s reading. The Dow Jones Industrial Average was down 10 points, or less than 0.1%, while the S&P 500 has dropped 0.2% and the Nasdaq Composite was down 0.1%. The consumer price index gained 3.1% year over year in November, in line with forecasts and down from 3.2% in October.

Published:12/12/2023 8:42:38 AM

|

|

[Markets]

Dow Jones Futures Rise After CPI Inflation Report; Tech Giant Oracle Dives On Earnings

Dow Jones futures rose Tuesday on the Consumer Price Index inflation report. Tech giant Oracle dived on weak sales results.

Published:12/12/2023 7:43:39 AM

|

|

[Markets]

Dow Jones Futures Rise Ahead Of CPI Inflation Report; Tech Giant Oracle Dives On Earnings

Dow Jones futures rose Tuesday ahead of the imminent CPI inflation report. AI giant Oracle dived on weak sales results.

Published:12/12/2023 7:17:42 AM

|

|

[Markets]

Dow Jones Futures: Magnificent Seven Stocks Slide; AI Giant Oracle Dives On Earnings; CPI Next

Dow Jones futures: The Magnificent Seven stocks tumbled Monday, with heavy losses in Nvidia and Tesla. The CPI inflation report is next.

Published:12/11/2023 4:41:38 PM

|

|

[Markets]

Dow Jones Rises 157 Points As Apple, Tesla Fall; This Warren Buffett Stock On 62% Run Clears Entry

The Dow Jones rose even as Apple stock and Tesla stock fell. A Warren Buffett stock cleared an entry point. Macy's stock rocketed on takeover news.

Published:12/11/2023 3:39:40 PM

|

|

[Markets]

How major US stock indexes fared Monday, 12/11/2023

The Nasdaq composite rose 0.2% and the Dow Jones Industrial Average added 0.4%. Major stock indexes are on a six-week winning streak, with the S&P 500 up 20% for the year. The Nasdaq composite rose 28.51 points, or 0.2%, to 14,432.49.

Published:12/11/2023 3:26:37 PM

|

|

[Markets]

Stocks Rise, Notch New Highs for 2023

The Dow Jones Industrial Average gained 157 points, or 0.4%, while the S&P 500 gained 0.4%, and the Nasdaq Composite advanced 0.2%. The indexes have notched impressive gains for the year, with the S&P 500 up more than 20%. Big Tech took the lead early in the year, as tech company earnings growth prospects have gotten even brighter on the back of opportunities related to artificial intelligence.

Published:12/11/2023 3:20:07 PM

|

|

[Markets]

Dow Jones Gains As Macy's Rockets; This Warren Buffett Stock On 62% Run Offers Entry

The Dow Jones rose as Macy's stock rocketed on takeover news. A Warren Buffett stock has cleared an entry. Apple stock and Tesla stock fell.

Published:12/11/2023 2:22:13 PM

|

|

[Markets]

Dow Jones Tech Titan Apple, AI Giants Nvidia, Snowflake Near Buy Points In Today's Stock Market

Dow Jones tech titan Apple, along with AI giants Nvidia and Snowflake, are in or near buy zones in today's stock market action.

Published:12/11/2023 1:31:06 PM

|

|

[Markets]

Dow Jones Rises On Mixed Fed Pivot Views; Warren Buffett's Oil Stock Enters Big Deal As Macy's Surges On Bid To Go Private

Dow Jones rose amid mixed views on when the Fed may start rate cuts. Macy's surged on a buyout offer, Occidental entered a huge private deal.

Published:12/11/2023 10:24:43 AM

|

|

[Markets]

Dow Jones Falls; Apple Headlines 9 Best Stocks To Buy And Watch

The Dow Jones fell Monday ahead of this week's CPI and Fed meeting. Apple stock headlines 9 best stocks to buy and watch.

Published:12/11/2023 9:09:44 AM

|

|

[Markets]

Stocks Open Mixed to Begin a Busy Week

The major stock indexes are mixed Monday as the market takes a breather from recent gains. The Dow Jones Industrial Average is up 67 points, or 0.2%, while the S&P 500 and Nasdaq Composite are down 0.1% and 0.5%, respectively. This comes after a Friday rally, a continuation of what has a been a 20% gain for the S&P 500 this year.

Published:12/11/2023 8:45:25 AM

|

|

[Markets]

Dow Jones Rises; Apple Headlines 9 Best Stocks To Buy And Watch

The Dow Jones rose Monday ahead of this week's CPI and Fed meeting. Apple stock headlines 9 best stocks to buy and watch.

Published:12/11/2023 8:39:23 AM

|

|

[Markets]

Dow Jones Futures Flatten Out; Apple Headlines 9 Best Stocks To Buy And Watch

Dow Jones futures dropped Monday ahead of this week's CPI and Fed meeting. Apple stock headlines 9 best stocks to buy and watch.

Published:12/11/2023 8:24:42 AM

|

|

[Markets]

Dow Jones Futures Fall; Apple Headlines 9 Best Stocks To Buy And Watch

Dow Jones futures dropped Monday ahead of this week's CPI and Fed meeting. Apple stock headlines 9 best stocks to buy and watch.

Published:12/11/2023 7:52:03 AM

|

|

[Markets]

12 Dow Stocks Billionaires Like The Most

In this piece, we will take a look at the 12 Dow stocks that billionaires like the most. If you don’t want to learn more about the Dow Jones Industrial Average (DJIA), its history, and recent performance, then skip ahead to 5 Dow Stocks Billionaires Like The Most. In its current form today, the Dow […]

Published:12/10/2023 12:22:02 PM

|

|

[Markets]

Should You Buy the 3 Highest-Paying Dividend Stocks in the Dow Jones?

Should you buy the three highest-paying dividend stocks in the Dow Jones right now? Walgreens Boots Alliance (NASDAQ: WBA) easily ranks at the top of our list. The retail and wholesale pharmacy giant's dividend yield currently stands at nearly 8.4%.

Published:12/10/2023 4:57:54 AM

|

|

[Markets]

Be Careful What You Wish For: This Event May Signal the Start of the 2024 Bear Market

The past four years have been nothing short of a wild ride for Wall Street. Since this decade began, the iconic Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC), have bounced back and forth between bear and bull markets in successive years. Currently, the Dow, S&P 500, and Nasdaq Composite are enjoying a major rally off of their 2022 bear market lows.

Published:12/10/2023 4:14:08 AM

|

|

[Markets]

Stocks Search for Direction After Latest Data

Stocks were vacillating between gains and losses on Friday as traders digested the latest set of economic data. The Dow Jones Industrial Average was up 0.1%. The S&P 500 was flat, while the Nasdaq Composite was up 0.

Published:12/8/2023 11:39:28 AM

|

|

[Markets]

Dow Jones Holds Firm Above 36,000 After Jobs Report; LULU Stock Reverses Higher After Earnings

The Dow Jones rose modestly Friday morning as Wall Street weighed the latest jobs report. Small caps outperformed as bond yields rose.

Published:12/8/2023 11:02:02 AM

|

|

[Markets]

Dow Jones Rises 140 Points After Jobs Report; LULU Stock Reverses Higher After Earnings

The Dow Jones rose modestly Friday morning as Wall Street weighed the latest jobs report. Small caps outperformed as bond yields rose.

Published:12/8/2023 9:59:35 AM

|

|

[Markets]

Stocks Turn Higher After Consumer Sentiment Data

Stocks turned higher Friday as an upbeat reading on inflation expectations overshadowed a stronger-than-expected jobs report. After opening in negative territory, the Dow Jones Industrial Average recovered to gain 128 points, or 0.4%. The S&P 500 rose 0.4%, while the Nasdaq Composite gained 0.5%.

Published:12/8/2023 9:41:02 AM

|

|

[Markets]

Dow Jones Reverses Higher On Strong Jobs Report; LULU Stock Tumbles On Earnings

The Dow Jones Industrial Average reversed Friday on a stronger-than-expected November jobs report. LULU stock tumbled on earnings.

Published:12/8/2023 8:57:41 AM

|

|

[Markets]

Stocks Fall, Yields Rise. The Labor Market Is Still Strong.

Stocks were slipping at Friday’s open after data showed that U.S. employers added more jobs than expected last month. The Dow Jones Industrial Average fell 26 points, or 0.1%. The S&P 500 fell 0.2%, while the Nasdaq Composite was down 0.

Published:12/8/2023 8:44:30 AM

|

|

[Markets]

Stock Futures Recover. Keep an Eye on the Open.

Stocks pared some of their losses right before opening bell on Friday after traders digested details in the November jobs report. Futures for the Dow Jones Industrial Average fell 0.1% versus the 0.4% loss seen around 8:30 am Eastern time.

Published:12/8/2023 8:24:24 AM

|

|

[Markets]

Dow Jones Futures Fall On Strong Jobs Report; LULU Stock Tumbles On Earnings

Dow Jones futures fell Friday morning on a stronger-than-expected November jobs report. LULU stock tumbled on earnings.

Published:12/8/2023 7:48:39 AM

|

|

[Markets]

Dow Jones Futures Fall Ahead Of Imminent Jobs Report ; LULU Stock Tumbles On Earnings

Dow Jones futures fell Friday morning ahead of the imminent November jobs report. LULU stock tumbled on earnings.

Published:12/8/2023 7:08:18 AM

|

|

[Markets]

Stocks Got an AI Boost. S&P 500, Dow Ended Losing Streaks.

Stocks notched gains on Thursday as investors flocked to AI-related stocks in droves. The Dow Jones Industrial Average gained 63 points, or 0.2%. The S&P 500 advanced 0.8%. The tech-heavy Nasdaq Composite gained 1.

Published:12/7/2023 3:08:56 PM

|

|

[Markets]

Dow Jones Up As AMD Soars Amid AI Fever; These 3 Bill Ackman Stocks Are Near Entries

The Dow Jones rallied. AMD stock popped amid an AI chip reveal. Some Bill Ackman stocks, including Google parent Alphabet, are near entries.

Published:12/7/2023 2:56:06 PM

|

|

[Markets]

Dow, S&P 500 Set to Snap Losing Streaks

Stocks made a strong recovery mid-Thursday as bonds yields lost ground. The Dow Jones Industrial Average had gained 88 points, or 0.25%. The S&P 500 had made its largest one-day gain since mid-November, moving up 0.

Published:12/7/2023 1:36:08 PM

|

|

[Markets]

Dow Jones Climbs After Jobless Claims Rise; Google Stock Surges After Gemini AI Model

The Dow Jones climbed Thursday after the Labor Department's jobless claims. Google stock surged after unveiling its Gemini AI model.

Published:12/7/2023 8:55:02 AM

|

|

[Markets]

Stocks Open Higher. Dow, S&P 500 Snap Losing Streaks.

Stocks moved decisively higher Thursday, with implications of Japan’s exit from negative interest rates and the state of the U.S. labor market on investors' minds. The Dow Jones Industrial Average was up 70 points, or 0.2%. The S&P 500 was up about 0.5%.

Published:12/7/2023 8:49:03 AM

|

|

[Markets]

Dow Jones Futures Reverse After Jobless Claims Rise; AI Stock C3.ai Plunges On Earnings

Dow Jones futures reversed higher Thursday after the Labor Department's jobless claims. AI stock C3.ai plunged on earnings.

Published:12/7/2023 8:12:33 AM

|

|

[Markets]

Dow Jones Futures Fall After Jobless Claims Rise; AI Stock C3.ai Plunges On Earnings

Dow Jones futures dropped Thursday after the Labor Department's jobless claims. AI stock C3.ai plunged on earnings.

Published:12/7/2023 7:35:43 AM

|

|

[Markets]

Dow Jones Futures Fall Ahead Of Jobless Claims; AI Stock C3.ai Plunges On Earnings

Dow Jones futures rose Thursday ahead of the Labor Department's jobless claims. AI stock C3.ai plunged on earnings.

Published:12/7/2023 7:23:30 AM

|

|

[Markets]

Dow Jones Flat As Elon Musk Offers $1 Billion In AI Race

Dow Jones rises on weak ADP jobs data for November. Disney rose amid news that activist investor Ancora supports Nelson Peltz's bid for a board seat.

Published:12/6/2023 2:22:55 PM

|

|

[Markets]

Dow Jones Flounders As Musk Ups AI Race With $1 Billion Offering

Dow Jones rises on weak ADP jobs data for November. Disney rose amid news that activist investor Ancora supported Nelson Peltz's bid for a board seat.

Published:12/6/2023 1:09:16 PM

|

|

[Markets]

Dow Jones Flat On Soft Jobs Data; Elon Musk Files $1 Billion Offering In AI Race

Dow Jones rises on weak ADP jobs data for November. Disney rose amid news that activist investor Ancora supported Nelson Peltz's bid for a board seat.

Published:12/6/2023 11:54:26 AM

|

|

[Markets]

Dow Jones Rises On Soft Jobs Data; Disney Climbs Amid Board Seat Wars

Dow Jones rises on weak ADP jobs data for November. Disney rose amid news that activist investor Ancora supported Nelson Peltz's bid for a board seat.

Published:12/6/2023 10:24:24 AM

|

|

[Markets]

The Dow Jones Is Aiming at All-Time Highs, and These 2 Stocks Are Leading the Charge

After a long bear market, the Dow Jones Industrial Average is within striking distance of record levels.

Published:12/6/2023 9:29:31 AM

|

|

[Markets]

Dow Jones Rises On Weak Jobs Data; Apple Stock Breaks Out Past Buy Point

The Dow Jones Industrial Average rose Wednesday on a weak ADP jobs report. Apple stock currently is breaking out past its latest buy point.

Published:12/6/2023 8:36:50 AM

|

|

[Markets]

Dow Jones Futures Rise After Weak Jobs Data; Apple Stock Breaks Out Past Buy Point

Dow Jones futures rose Wednesday after a weak ADP jobs report. Apple stock is breaking out past its latest buy point.

Published:12/6/2023 7:39:32 AM

|

|

[Markets]

This Dow Dividend Giant Missed the 2023 Rally. Is It a Buy Now?

The Dow Jones Industrial Average recently touched a 2023 record, rising to an 8% overall return through late November. Investors have been thrilled to see signs of slowing inflation and strong economic growth, and are responding to the good news by pushing the index higher. Not all Dow stocks are benefiting from this surging optimism.

Published:12/6/2023 5:09:20 AM

|

|

[Markets]

The Dow Jones Just Did Something It Hasn't Done Since 2021. It Could Signal a Big Move in the Stock Market

The Dow Jones Industrial Average notched five consecutive weekly increases during November, something the blue chip index last did in 2021.

Published:12/5/2023 6:39:34 PM

|

|

[Markets]

Dow Jones Eases As Microsoft Stock Tests A New Entry; Sphere Stock Tanks 14%

Large and mega-cap stocks outperformed on the stock market today as the Dow Jones Industrial Average slipped, but fell less than the Russell 2000. One large stock, Microsoft, got support at a key technical level while testing a 366.78 buy point, as concert venue upstart Sphere Entertainment sold off and hit five-month lows. The S&P 500 traded practically at the break-even point.

Published:12/5/2023 2:35:43 PM

|

[Markets]

Wall Street Analysts Are Optimistic For 2024

Wall Street Analysts Are Optimistic For 2024

Authored by Lance Roberts via RealInvestmentAdvice.com,

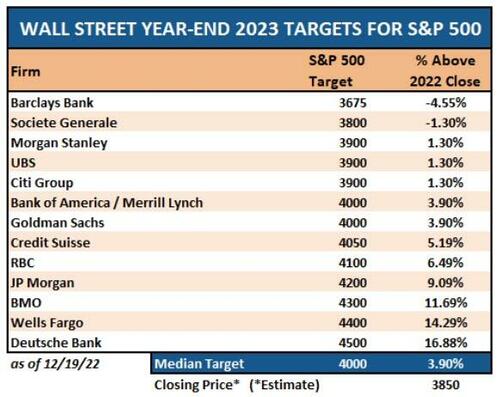

It’s that time of the year where Wall Street polishes up their crystal balls and pin targets on the S&P index for the upcoming year. As is often the case, while Wall Street is always optimistic, the forecasts prove pretty wrong.

For example, on December 7th, 2021, we wrote an article about the predictions for 2022.

“There is one thing about Goldman Sachs that is always consistent; they are ‘bullish.’ Of course, given that the market is positive more often than negative, it ‘pays’ to be bullish when your company sells products to hungry investors.

It is important to remember that Goldman Sachs was wrong when it was most important, particularly in 2000 and 2008.

However, in keeping with its traditional bullishness, Goldman’s chief equity strategist David Kostin forecasted the S&P 500 will climb by 9% to 5100 at year-end 2022. As he notes, such will “reflect a prospective total return of 10% including dividends.”

The problem, of course, is that the S&P 500 did NOT end the year at 5100.

Then, in 2022, Wall Street analysts suggested that 2023 would be a year of meager return of just 3.9% with a median price target of 4000.

Of course, reality turned out to be markedly different.

However, the guessing game is an annual tradition of Wall Street analysts and, as is always the case, to borrow a quote:

“(Market) Predictions Are Difficult…Especially When They Are About The Future” – Niels Bohr

Okay, I took a little poetic license, but the point is that while we try, predictions of the future are difficult at best and impossible at worst. If we could accurately predict the future, fortune tellers would win all the lotteries, psychics would be richer than Elon Musk, and portfolio managers would always beat the index.

However, all we can do is analyze what occurred previously, weed through the noise of the present, and discern the possible outcomes of the future. The biggest problem with Wall Street, both today and in the past, is the consistent disregard of the unexpected and random events they inevitability occur.

We have seen plenty, from trade wars to Brexit, to Fed policy and a global pandemic in recent years. Yet, before those events caused a market downturn, Wall Street analysts were wildly bullish that wouldn’t happen.

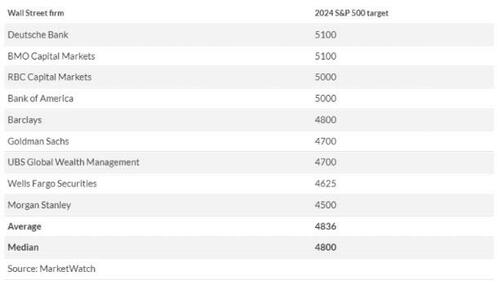

So what about 2024? We have some early indications of Wall Street targets for the S&P 500 index, and, as is always the case, they are primarily optimistic for the coming year.

“The estimates from sell-side strategists put the average target for the S&P 500 at 4,836 for the end of 2024, implying an advance of merely 6.3% from Monday’s close, according to MarketWatch calculations of the data (see table below). That is below the average yearly return of around 8% for the large-cap index since 1957 and its year-to-date surge of 18.5% in 2023, according to Dow Jones Market Data.” – MorningStar

Will next year be another bull market year for stocks, or will the bear finally come out of hibernation? We don’t have a clue but can make educated guesses about ranges given current valuations.

Estimating The Outcomes

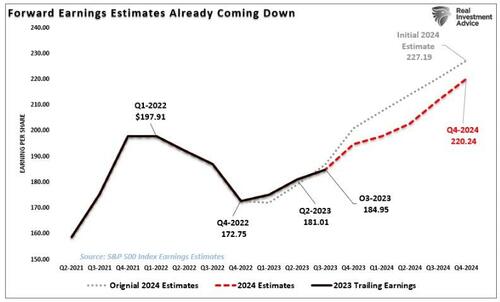

The problem with current forward estimates is that several factors must exist to sustain historically high earnings growth.

-

Economic growth must remain more robust than the average 20-year growth rate.

-

Wage and labor growth must reverse to sustain historically elevated profit margins, and,

-

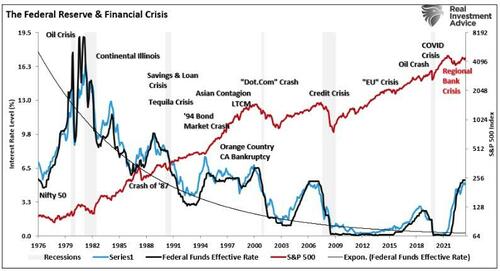

Both interest rates and inflation must reverse to very low levels.

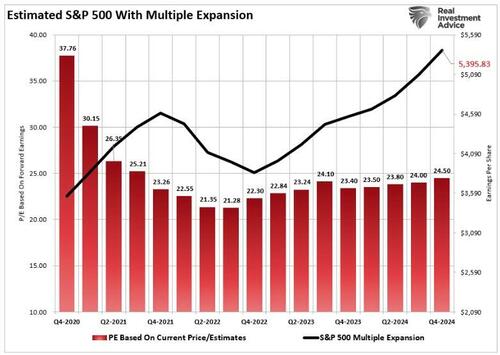

While such is possible, the probabilities are low, as strong economic growth can not exist in a low inflation and interest-rate environment. More notably, if the Fed cuts rates, as most economists and analysts expect next year, such will be in response to a near-recessionary or recessionary environment. Such would not support current strong earnings estimates of $220.24 per share next year. This represents roughly 20% from Q3-2023 levels, which is the most recently completed quarter.

Nonetheless, with that said, we can use the current forward estimates, as shown above, to estimate both a recession and non-recession price target for the S&P 500 as we head into 2024. These assumptions are based on valuation multiples within ranges of current market levels.

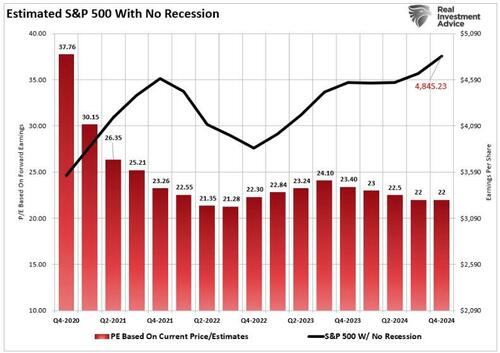

In the NO-recession scenario, the assumption is that valuations will fall slightly as earnings increase to 22x earnings over the next year. (22x earnings has been the average over the last few years.) The S&P 500 should theoretically trade at roughly 4845 by 2024 based on current estimates. Given the market is trading at approximately 4550 (at the time of this writing), such would imply a 6.5% increase from current levels.

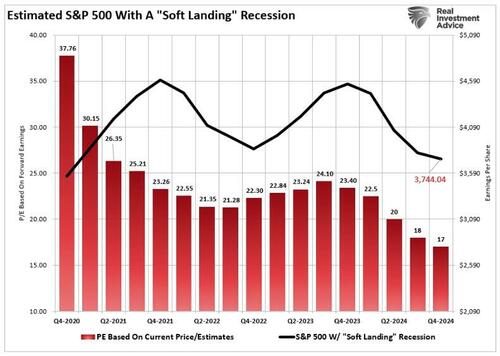

However, should the economy slip into a mild recession, valuations would be expected to revert toward the longer-term median of 17x earnings. Such would imply a level of 3744 or roughly a 17% decline next year.

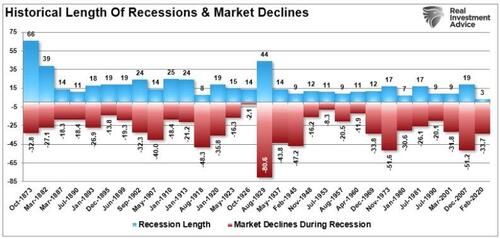

While an additional 17% decline from current levels seems hostile, such would align with typical recessionary bear markets.

Which would also coincide with Fed rate cuts to offset the deflationary risk to the economy.

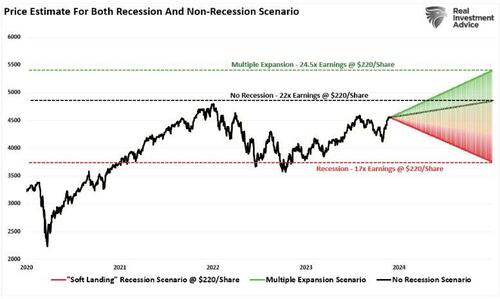

However, we must consider one more scenario.

Maybe The Bulls Are Right

We would be remiss in not providing for a bullish outcome in 2024. However, we must consider several factors for that bullish outcome to take shape.

-

We assume the $220/share in year-end estimates remains valid.

-

That the economy avoids a recession even as inflation falls

-

The Federal Reserve pivots to a lower interest rate campaign.

-

Valuations remain static at 22x earnings.

In this scenario, the S&P 500 should rise from roughly 4550 to 5395 by the end of 2024. Such would imply an 18.5% gain for the year. Given the market is up approximately 19% in 2023, such a gain

The chart below combines the three potential outcomes to show the range of possible outcomes for 2024. Of course, you can do the analysis, make valuation assumptions, and derive your targets for next year. This is just a logic exercise to develop a range of possibilities and probabilities over the next 12 months.

Conclusion

Here is our concern with the bullish scenario. It entirely depends on a “no recession” outcome, and the Fed must reverse its monetary tightening. The issue with that view is that IF the economy does indeed have a soft landing, there is no reason for the Federal Reserve to reverse reducing its balance sheet or lower interest rates.

More importantly, the rise in asset prices eases financial conditions, which reduces the Fed’s ability to bring down inflation. Such would also presumably mean employment remains strong along with wage growth, elevating inflationary pressures.

While the bullish scenario is possible, that outcome faces many challenges in 2024, given the market already trades at fairly lofty valuations. Even in a “soft landing” environment, earnings should weaken, which makes current valuations at 22x earnings more challenging to sustain.

Our best guess is that reality lies somewhere in the middle. Yes, there is a bullish scenario where earnings decline and a monetary policy reversal leads investors to pay more for lower earnings. But that outcome has a limited lifespan as valuations matter to long-term returns.

As investors, we should hope for lower valuations and prices, which gives us the best potential for long-term returns. Unfortunately, we don’t want the pain of getting there.

Regardless of which scenario plays out in real-time, there is a reasonable risk of weaker returns over the next year than what we saw in 2023.

That is just the math.

|

|

[Markets]

Dow Jones Falls 180 Points After Key Economic Data; Nvidia, Tesla Stock Rebound

The Dow Jones dropped 180 points Tuesday after key economic data. Tech titans Nvidia and Tesla rebounded from Monday's sharp losses.

Published:12/5/2023 9:24:18 AM

|

|

[Markets]

Dow Jones Falls Ahead Of Key Economic Data; Nvidia, Tesla Bounce

The Dow Jones dropped Tuesday ahead of key economic data. Tech titans Nvidia and Tesla threatened to extend Monday's sharp losses.

Published:12/5/2023 8:53:19 AM

|

|

[Markets]

Stocks Open Lower as Market Digests November Rally

Stocks opened lower on Tuesday as traders digested the market’s recent rally. The Dow Jones Industrial Average was down 81 points, or 0.2%. The S&P 500 was down 0.3%. The Nasdaq Composite was down 0.4%.

Published:12/5/2023 8:44:55 AM

|

|

[Markets]

Dow Jones Futures Fall Ahead Of Key Economic Data; Nvidia, Tesla Extend Losses

Dow Jones futures dropped Tuesday ahead of key economic data. Tech titans Nvidia and Tesla threatened to extend Monday's sharp losses.

Published:12/5/2023 7:29:32 AM

|

|

[Markets]

Market Extra: After best stretch since 2020, how much higher can stocks climb? Here is what history shows us.

U.S. stocks pulled back on Monday following the best five-week stretch for the S&P 500 since 2020, Dow Jones Market Data show.

Published:12/5/2023 7:12:33 AM

|

|

[Markets]

Dow Jones Futures: Jobs Report Looms As Magnificent Seven Stocks Tumble

Dow Jones futures: The Magnificent Seven stocks tumbled Monday, as Alphabet, Nvidia and Tesla stock finished with sharp losses.

Published:12/4/2023 3:51:41 PM

|

|

[Markets]

How major US stock indexes fared Monday, 12/4/2023

Stocks slipped on Wall Street ahead of some key reports this week on the job market that might provide more insight into the Federal Reserve’s thinking about interest rates. The Dow Jones Industrial Average fell 41 points, and the Nasdaq composite fell 0.8%. Alaska Airlines slumped after it said it would buy Hawaiian Airlines.

Published:12/4/2023 3:19:24 PM

|

|

[Markets]

Dow Jones Dips As Uber Stock Jumps; Cathie Wood Sells This Stock On Monster 109% Run

The Dow Jones fell as Uber stock surged. Nvidia stock and Tesla stock were among Magnificent 7 members falling. Cathie Wood sold a stock amid a big run.

Published:12/4/2023 2:41:20 PM

|

|

[Markets]

Dow Jones Leader Boeing, Chip Giant ARM Near Buy Points In Today's Stock Market

Dow Jones aerospace leader Boeing and chip designer ARM are approaching new buy points in today's stock market action.

Published:12/4/2023 2:34:09 PM

|

|

[Markets]

Stocks Fall to Start Week

Stocks slipped at the start of Monday, threatening to end their winning streak as markets await a flurry of labor market data later this week. Shortly after the open, the Dow Jones Industrial Average was down 139 points, or 0.

Published:12/4/2023 8:51:01 AM

|

|

[Markets]

Dow Jones Falls As Bitcoin Surges Above $42,000; Nvidia, Tesla Sell Off

The Dow Jones fell Monday, as bitcoin surged above $42,000 for the first time since April 2022. Nvidia and Tesla stock sold off.

Published:12/4/2023 8:37:03 AM

|

|

[Markets]

Is It Time to Buy the Dow Jones' 3 Worst-Performing November Stocks?

Last month was a much-needed win for the stock market. When all was said and done the Dow Jones Industrial Average (DJINDICES: ^DJI) gained nearly 9% in November, reversing a nasty downtrend and reaching a new multi-month high in the process. Not every Dow stock followed suit, though.

Published:12/4/2023 8:30:32 AM

|

|

[Markets]

Dow Jones Futures Fall As Bitcoin Surges Above $42,000; Uber Jumps On S&P 500 Inclusion

Dow Jones futures fell Monday, as bitcoin surged above $42,000 for the first time since April 2022. Uber stock jumped on S&P 500 inclusion.

Published:12/4/2023 7:17:11 AM

|

|

[Markets]

Dow Jones Futures Fall; ARM, Palantir Lead 7 Stocks In Buy Areas

Dow Jones futures fell modestly early Monday, along with S&P 500 futures and Nasdaq futures. The stock market rally briefly hinted it might be ready for a pause, as megacaps Meta Platforms, Google parent Alphabet and Nvidia faltered somewhat.

Published:12/4/2023 6:04:59 AM

|

|

[Markets]

U.S. Money Supply Is Shrinking for the First Time Since the Great Depression, and It May Portend a Big Move for Stocks

Since this decade began, the Dow Jones, S&P 500, and Nasdaq Composite have bounced back and forth between bull and bear markets in each successive year. While there's no predictive tool or metric that can, with guaranteed accuracy, always predict short-term directional moves in the Dow, S&P 500, and Nasdaq Composite, there are select indicators and datapoints that strongly correlate with directional changes in the broader market.

Published:12/3/2023 4:18:16 AM

|

|

[Markets]

How major US stock indexes fared Friday, 12/1/2023

The Dow Jones Industrial Average rose 294 points and the Nasdaq composite added 0.6%. In company news, Ulta Beauty soared 10.8% after reporting better-than-expected results for its latest quarter and raising its forecast. Gainers outnumbered decliners by roughly 6-to-1 on the New York Stock Exchange.

Published:12/1/2023 3:54:41 PM

|

|

[Markets]

Dow, S&P 500 Hit New 2023 Closing Highs

The Dow Jones Industrial Average and the S&P 500 hit new closing highs for 2023 on Friday, as stocks rose again to wrap a fifth straight week of gains for the three major U.S. indexes. The Dow finished up about 295 points, or 0.

Published:12/1/2023 3:20:17 PM

|

|

[Markets]

US STOCKS-S&P, Nasdaq slip as caution prevails ahead of Powell comments

The S&P 500 and Nasdaq fell on Friday as investors were on edge ahead of Federal Reserve Chair Jerome Powell's comments that some fear may have a hawkish tilt towards monetary policy. This comes after both the indexes finished November with their biggest monthly gain since July 2022, while the Dow Jones rallied to close at its highest level since January 2022.

Published:12/1/2023 9:13:58 AM

|

|

[Markets]

Dow Jones Falls Ahead Of Powell Comments; Tesla Slides On Cybertruck Event

The Dow Jones dropped Friday ahead of Fed Chair Jerome Powell's comments. Tesla stock skidded after the Cybertruck delivery event.

Published:12/1/2023 9:08:02 AM

|

|

[Markets]

Asia Markets Mostly Lower, Europe On The Rise, Gold Steady Above $2K Levels - Global Markets Today While US Was Sleeping

On Thursday, Nov. 30, U.S. stock markets closed mixed, with the Dow Jones Industrial Average gaining more than 500 points. In economic data, The U.S. October personal consumption expenditure price index remained stable, following September’s 0.4% increase. Annual core PCE inflation decreased to 3.5% from 3.7%. U.S. jobless claims increased to 218,000 for the week ending Nov. 25, up from 211,000 the prior week and below the 220,000 forecast. Chicago PMI jumped to 55.8 in November from 44 in Octob

Published:12/1/2023 8:04:04 AM

|

|

[Markets]

Dow Jones Futures Fall Ahead Of Powell Comments; Tesla Slides On Cybertruck Event

Dow Jones futures dropped Friday ahead of Fed Chair Jerome Powell's comments. Tesla stock skidded after the Cybertruck delivery event.

Published:12/1/2023 7:22:58 AM

|

|

[Markets]

Dow Jones Futures Rise, Techs Fall; Tesla Skids On Cybertruck Details

Dow futures rose after the Dow Jones hit a 2023 high. Samsara led software earnings winners overnight. Cybertruck deliveries began, but Tesla fell amid details.

Published:12/1/2023 6:58:53 AM

|

|

[Markets]

Dow Jones Futures Rise; Tesla Falls On Cybertruck Details But These Techs Soar

Dow futures rose after the Dow Jones hit a 2023 high. Samsara led software earnings winners overnight. Cybertruck deliveries began, but Tesla fell amid details.

Published:12/1/2023 6:08:15 AM

|

|

[Markets]

Dow Jones Hits 2023 High As Salesforce Soars; Tesla Falls On Cybertruck Prices, Range

The Dow Jones hit a 2023 high as Salesforce and UnitedHealth jumped. Tesla deliveries began, and the company finally revealed prices and range. TSLA stock fell in Thursday's session and beyond.

Published:11/30/2023 4:53:13 PM

|

|

[Markets]

Dow Jones Surges 520 Points As Salesforce Soars; Elon Musk Hypes 'Bulletproof' Tesla Cybertruck

The Dow Jones roared as Salesforce stock surged on earnings. Tesla stock fell as Elon Musk hyped the bulletproof qualities of the Cybertruck.

Published:11/30/2023 3:54:42 PM

|

|

[Markets]

US STOCKS-Dow reaches 2023 closing high as markets turn the page on a robust November

The Dow Jones Industrial Average closed at its highest level this year as investors crossed the finish line of a banner month for stocks and viewed cooling inflation data in the context of Federal Reserve monetary policy. "We're putting the cherry on top of a banner month," said Ryan Detrick, chief market strategist at Carson Group in Omaha. Among data released Thursday morning, the Commerce Department's closely watched Personal Consumption Expenditures (PCE) report showed inflation is cooling as expected, along with consumer spending.

Published:11/30/2023 3:05:24 PM

|

|

[Markets]

Dow Jones Rallies, Nasdaq Lags As Salesforce Surges; Elon Musk Hypes Tesla Cybertruck Deliveries

The Dow Jones Industrial Average jumped as Salesforce stock surged on stellar earnings. Tesla stock fell as Elon Musk hyped the Cybertruck.

Published:11/30/2023 2:38:59 PM

|

|

[Markets]

US STOCKS-Dow touches 2023 peak as investors eye end of robust November

The Dow Jones Industrial Average touched its 2023 peak, but the S&P 500 and the Nasdaq lagged as investors approached the finish line of a banner month for stocks and viewed cooling inflation data through the lens of Federal Reserve monetary policy. The Dow was the clear outperformer, breaching its 2023 intraday high with a solid boost from Salesforce on the heels of its consensus-beating earnings report.

Published:11/30/2023 1:32:27 PM

|

|

[Markets]

Nvidia Stock Is Running Out Of Steam. This Dow Jones Chip Stock Deserves Attention.

Recent action in Nvidia stock points to consolidation. Could this Dow Jones stock yield more immediate returns?

Published:11/30/2023 1:24:26 PM

|

|

[Markets]

US STOCKS-Dow hits 2023 peak as Salesforce jumps, inflation eases